More Care Served and Yet Less Cash Realized?

How Rural Hospitals Can Close the AR Gap

Rural hospitals don’t just support American healthcare; they hold it together.

They care for more than 60 million Americans, serving nearly 20% of the U.S. population. And yet, despite this outsized responsibility, many rural hospitals struggle to get paid for the care they deliver.

More patients and yet less cash, slower collections, and higher risk of closure.

The Financial Reality Rural Hospitals Are Living With

At the center of this financial pressure sits one of the most underrated problems in rural healthcare revenue cycle management (RCM): accounts receivable (AR) management.

The issue isn’t effort or lack of it. It’s revenue leakage that’s systemic, largely invisible until it’s too late, and increasingly expensive to operate within traditional, manual AR workflows.

Where Earned Revenue Quietly Disappears

1 in every 7 medical claims (~15%) is denied on first submission due to documentation gaps.

Nearly ~40% of the time is spent on manual checks and follow-ups, which drives up the cost to collect.

Over $130 billion annually in underpayments account for more lost revenue than denied dollars.

For rural hospital CFOs and revenue cycle leaders, these trends indicate a stark paradox: less cash realized despite more care delivered.

How AR Challenges Compound in Rural Hospitals

Denials that Drain Already-Thin Margins

- Smaller AR and billing teams

- Limited specialty coders

- Manual workflows

Underpayments that Go Undetected

- Many short-pays remain buried inside 835 remittance files

- Without line-level reconciliation, they’re posted as “paid”and forgotten

AR that Ages without a Clear, ROI-driven Recovery Strategy

- Aging-based worklists instead of ROIbased prioritization

- Manual follow-ups instead of automated status checks

- Staff working low-dollar claims while high-value opportunities sit untouched

Why AR Failure Is a Bigger Threat in Rural Healthcare

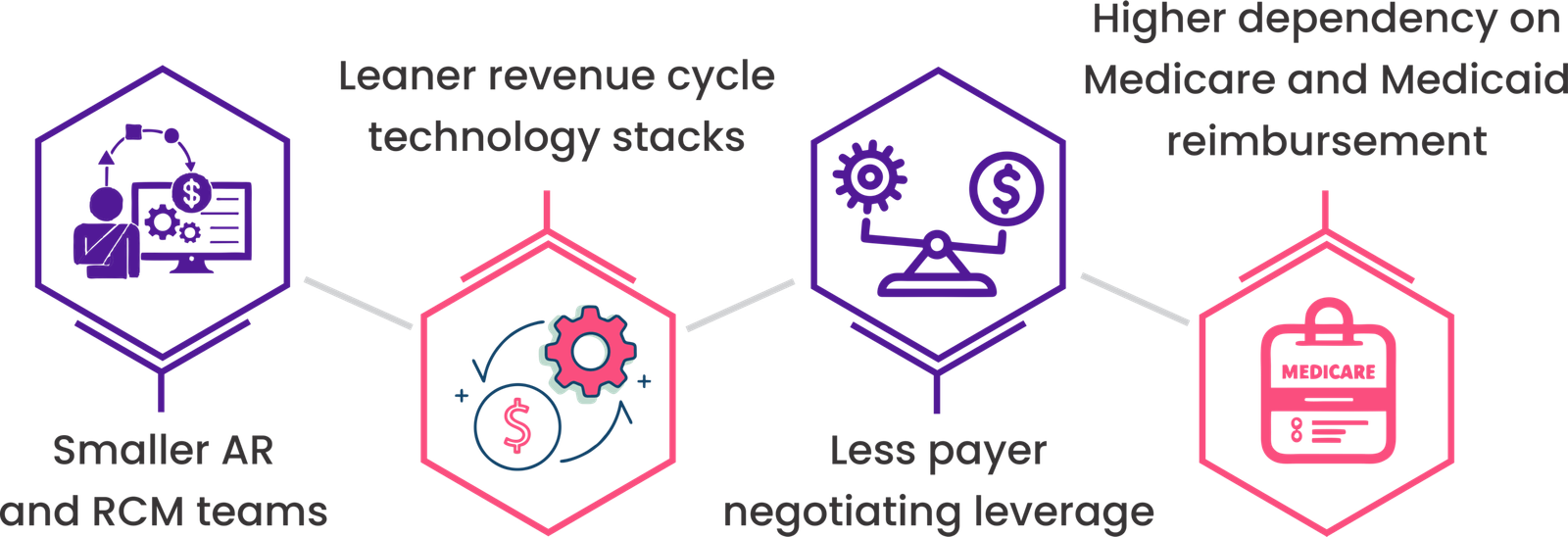

Rural hospitals don’t have the luxury of scale. They typically operate with:

And thus, when AR workflows break down, there’s no buffer. Cash flow challenges turn into staffing shortages, service line cuts, and, in worst cases, permanent closure.

The Questions Rural Healthcare CFOs and RCM Leaders Should be Asking

If you lead finance or revenue cycle in a rural system, these questions should be top of your mind:

- How much money are we missing from underpayments we never catch?

- Are we working on the right claims—or just the oldest ones?

- Which denials are actually worth fighting?

- How much staff time is spent chasing claims that will never pay?

When AR is managed reactively, these answers remain unclear—and revenue remains stuck.

Why Traditional AR Models Fall Short

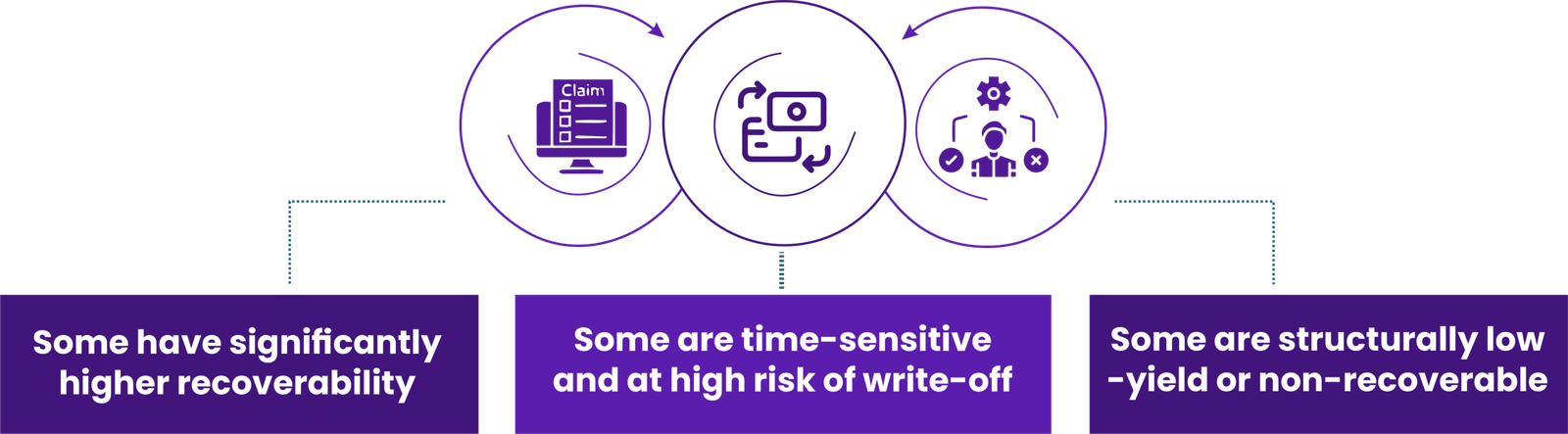

The legacy approach to AR assumes all claims deserve equal attention. However, in reality:

Without data-driven insight, rural teams are forced into survival mode—working harder instead of smarter. That’s expensive. And rural hospitals can’t afford expensive inefficiency.

Why Traditional AR Models Fall Short

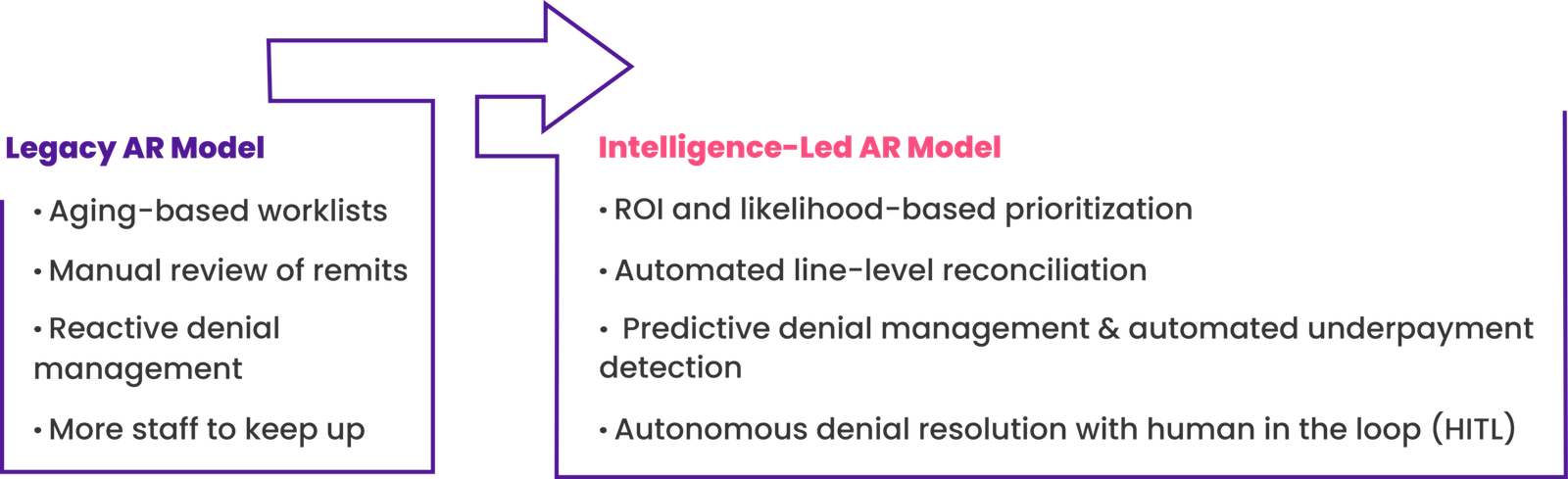

From Reactive, Labor-Led AR to Proactive Intelligence-Led AR

High-performing rural hospitals are rethinking AR that’s intelligence-led to improve and sustain cash flow and minimize the cost to collect.

They’re moving from legacy AR management to intelligence–led AR models.

At the center of this shift is revenue intelligence that understands payer nuances, denial patterns, and underpayments at risk to work recoverable claims at scale.

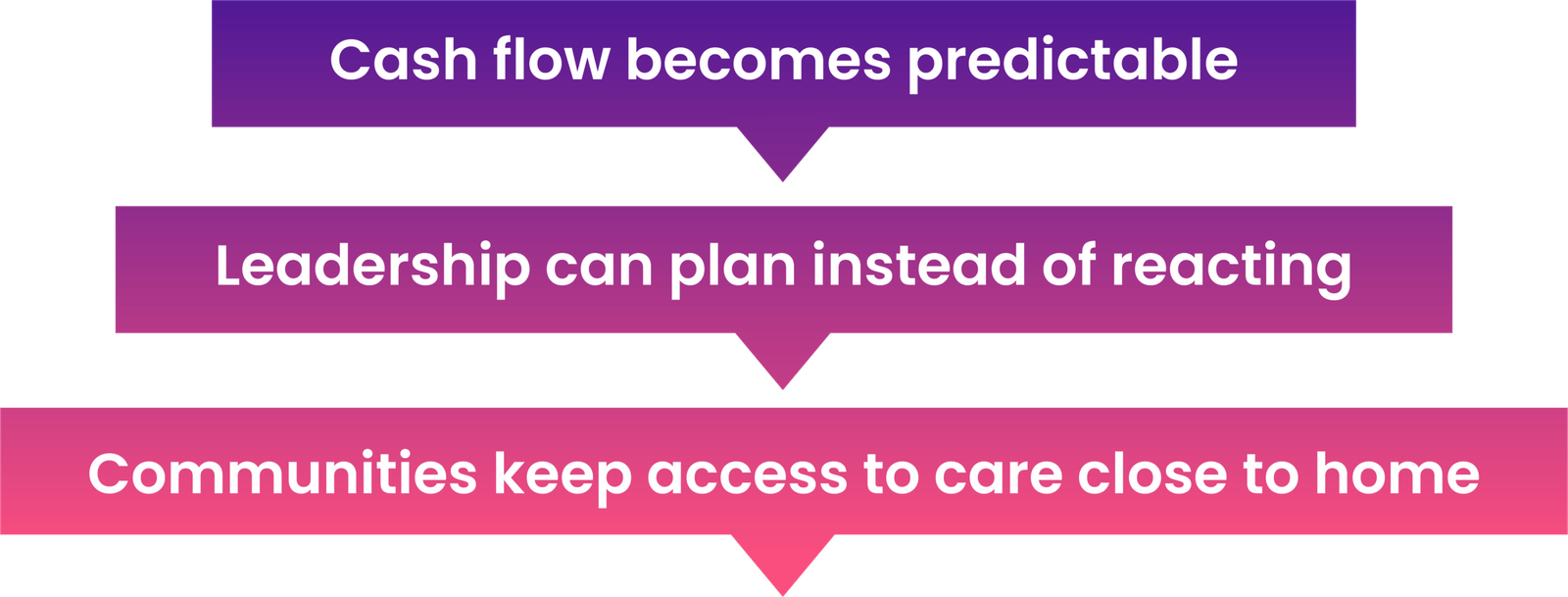

Why This Matters Beyond the Balance Sheet

When rural hospitals stabilize AR:

Because in rural America, every recovered dollar protects patient access.

How Jindal Healthcare Enables Smarter Rural AR Management

Jindal Healthcare’s AI for RCM is designed specifically for high-complexity environments like rural healthcare, where traditional workflows often break down.

And here’s how our RCM engine optimizes AR workflows for improved bottom line:

Automated Underpayment Detection

- Line-level reconciliation of remittances (835) against submitted claims (837)

- Automated detection and flagging of underpayments and incorrect payer adjustments

- Pattern analysis by payer, CPT, modality, and site of service to surface systemic issues

Faster Denial Resolution with HITL

- Automated appeal generation with required clinical and authorization documentation

- Smart routing to subject-matter experts, so humans only intervene when their judgment is required in nuanced contexts

Smart Claim Prioritization by ROI

- AI-led claim prioritization based on recoverable value, success likelihood, and ROI

- Priority queueing of high-dollar, high-opportunity cases

- Automated claim status checks and payer follow-ups

Proactive Denial Prevention

- Continuous analysis of denial reasons by payer, CPT, modality, site of service, and ordering pattern

- Insights fed back into front-end and mid-cycle workflows, enabling a continuous learning loop

How Radiology Leaders Are Witnessing AR Transformation

35%

increase in recoverable revenue from denials and underpayments

50%

reduction in RCM operating cost through automation and smarter prioritization

60%

decline in 90+ day AR, accelerating cash without adding headcount

The Bottom Line for Rural Healthcare CFOs and RCM Leaders

Rural hospitals serve one-fifth of the U.S. population with fewer resources and higher financial pressure than almost any other provider group.

Even as CMS commits over $50 billion to strenghthen rural healthcare increased patient volume would mean more claims—and without intelligent AR optimization, more revenue leakage.

For rural hospitals, funding expands care, but AR performance determines whether that care turns into cash. With the right visibility, prioritization, and prevention strategies, AR can become a source of stability and not stress.

Let’s Compare Notes

If you’re evaluating revenue cycle management (RCM) solutions to reduce denials, uncover underpayments, and accelerate cash without overwhelming your teams, a focused AR review is often the fastest place to start.

Connect with us for a brief expert consultation to understand where revenue’s leaking in your RCM and how you can recover it.

Because sustainable cash flow is what keeps rural hospitals serving their communities.

You might also like: